The RBC blog provides inspiring ideas and beneficial strategies to help you prepare for retirement. Additionally, we broadcast timely updates, useful tips & tricks, and vital notifications pertaining to the Retirement Budget Calculator.

7 Simple exercises to help you plan the best year of your life

Trying to net a specific dollar amount from an IRA distribution? Don’t guess the gross. Use this simple formula (and our calculator) to back into the right gross amount after withholding. When retirees ask for a certain after-tax amount from their IRA, the most common mistake is adding tax on top of the net. That approach almost always leaves you short. The correct way is to divide the net by what you keep after withholding. This post shows the simple math, a quick example, and the error to avoid—plus an embeddable calculator to do it for you.

The Retirement Budget Calculator is a powerful retirement planning tool with budgeting, tax planning, Social Security optimization, Monte Carlo analysis, withdrawal strategies, and more. Plan your retirement with confidence.

The Federal Employee Health Benefits (FEHB) program is one of the most valuable retirement benefits for federal employees, but understanding how it works after you leave service is key to maximizing its value. To keep FEHB in retirement, you must retire on an immediate annuity and have been enrolled for the five years before retirement. The government continues to pay most of the premium, but retirees lose the pre-tax advantage, making premiums feel more expensive. While pensions receive annual cost-of-living adjustments, they often lag behind the faster rise in FEHB premiums, creating long-term budgeting challenges. Coordinating FEHB with Medicare—especially Part B—can provide broad protection, with FEHB acting as a “super supplement” for services Medicare doesn’t cover, but the decision depends on personal health, income, and risk tolerance.

If you're turning 73 or 75 soon, understanding Required Minimum Distributions (RMDs) is essential for managing your retirement income and taxes. This post explains when RMDs begin, how they’re calculated using the IRS Uniform Lifetime Table, and includes tables showing both distribution factors and their equivalent withdrawal percentages. Plan ahead to avoid penalties and optimize your retirement cash flow.

If one spouse files for Social Security early and the other delays until age 70, it’s still possible to receive a higher spousal benefit — but only if you understand how the rules work. This post explains how early filing reductions, spousal top-up benefits, and survivor benefits interact, using a real-life example to show how strategic timing can significantly impact retirement income for couples.

The blog post outlines 12 surprising lessons that retirees often encounter as they transition into retirement.

In this blog post, we explore the importance of managing expectations and embracing market volatility by analyzing 20 years of data from the Russell 3000 Index. Through a historical lens, we highlight how understanding past market trends can help investors maintain a balanced perspective, avoid emotional decision-making, and stay committed to long-term financial goals. The post emphasizes the value of realistic expectations, diversification, and having a solid financial plan to navigate the inevitable ups and downs of the stock market with confidence.

Choosing the right retirement planning tool is essential. The Retirement Budget Calculator (RBC) offers a highly customizable and accurate approach, with features like detailed budgeting, inflation adjustments, and AI assistance, making it ideal for those seeking in-depth planning within the next five years. In contrast, Dave Ramsey's Retirement Calculator focuses on helping users determine how much they need to save for retirement, offering a straightforward, simple approach. Your choice depends on your retirement planning needs and your comfort level with financial details.

Recent research has demonstrated the potential advantages of using a bucket strategy for retirement withdrawals. This approach divides funds into time-segmented "buckets" with distinct asset allocations, each regularly rebalanced to maintain its intended strategy. When compared to a traditional 60/40 portfolio, which is also rebalanced annually, the bucket strategy showed significantly better outcomes over a 30-year period. The findings suggest that incorporating both time-segmented investing and regular rebalancing can lead to more effective retirement planning.

The Pyramid of Investing Success provides a structured approach to building a strong, enduring investment strategy for retirement. It starts with understanding the purpose of your money and adopting a sound investment philosophy. Key elements include a solid financial plan, diversification across global markets, and incorporating factor investing—tilting towards small-cap, value, and high-profitability stocks for higher expected returns. Disciplined rebalancing and effective tax strategies further enhance stability and growth. By focusing on these fundamentals, you can achieve clarity, confidence, and financial freedom in retirement.

This blog post explores the critical decision retirees face between taking a lump sum or opting for a pension. It emphasizes the importance of evaluating this choice within a comprehensive retirement cash flow plan, considering factors like guaranteed income, inflation, life expectancy, and investment management. Using tools like the Retirement Budget Calculator and a specialized spreadsheet, the post guides readers through creating and comparing different scenarios to make an informed decision. Ultimately, it stresses the need to make this choice in the context of your overall financial goals and comfort with managing investments.

Deciding whether to pay off your mortgage at retirement or invest your savings is a personal choice that depends on your financial goals, risk tolerance, and comfort with debt. Paying off the mortgage can offer peace of mind and reduce your monthly expenses, but it may also limit your financial flexibility and growth potential. On the other hand, keeping the mortgage and investing your savings could lead to higher long-term returns and greater liquidity, but it involves ongoing debt and potential tax implications. Ultimately, the right decision should align with your overall retirement plan and what brings you the most financial security and peace of mind.

If you're close to retirement, you may be wondering how much money you need to have saved.Or maybe you're within 5 years of retirement and want to get a head start on planning. Either way, Retirement Calculator: How much money do I need to Retire? is the perfect book for you!

After spending many years accumulating assets for retirement, you need a strategy for retirement withdrawals. How do you choose between a traditional static portfolio, the infamous bucket strategy, an upwards glidepath, or some other strategy?

When planning for retirement, it is important to have as much information as possible to make the best decisions so that you can have the most confidence heading into retirement. That's why using a retirement calculator is such a valuable tool.

A comparison of various strategies to reduce taxes when withdrawing from retirement accounts.

The purpose of this article is to demonstrate how Barney, who is close to retirement, would enter his paycheck and other taxable income into the RBC budget to get an accurate estimate of federal taxes.

When it comes to retirement planning, there are a lot of factors to consider. How much money do you need to retire? What will your monthly expenses be? How long will your retirement savings need to last? These are all important questions that need answers. In this article, we will provide an in-depth guide on how to calculate how much money you need for retirement.

When planning for retirement, it is important to include all of your potential expenses. This can be tricky, as there are many different factors to consider. In this blog post, we will discuss the 7 categories of retirement expenses and then provide a list of 65 specific expenses you will want to include in your retirement spending plan. By taking into account all of these costs, you can create a realistic plan that will help you enjoy a comfortable retirement! You may utilize the Retirement Budget Calculator for free to assist you to plan your spending for retirement.

Are you worried about your retirement? You're not alone! Retirement planning can seem daunting, but it doesn't have to be. In this blog post, we will discuss how to create a free budget for retirement. We will go over different strategies that you can use to figure out how much you spend which in turn will help you know if you have saved enough for retirement.

In many marriages, one spouse will often take the lead in handling the couple’s financial tasks, including retirement planning, while the other is happy to let the finance person handle all the details.

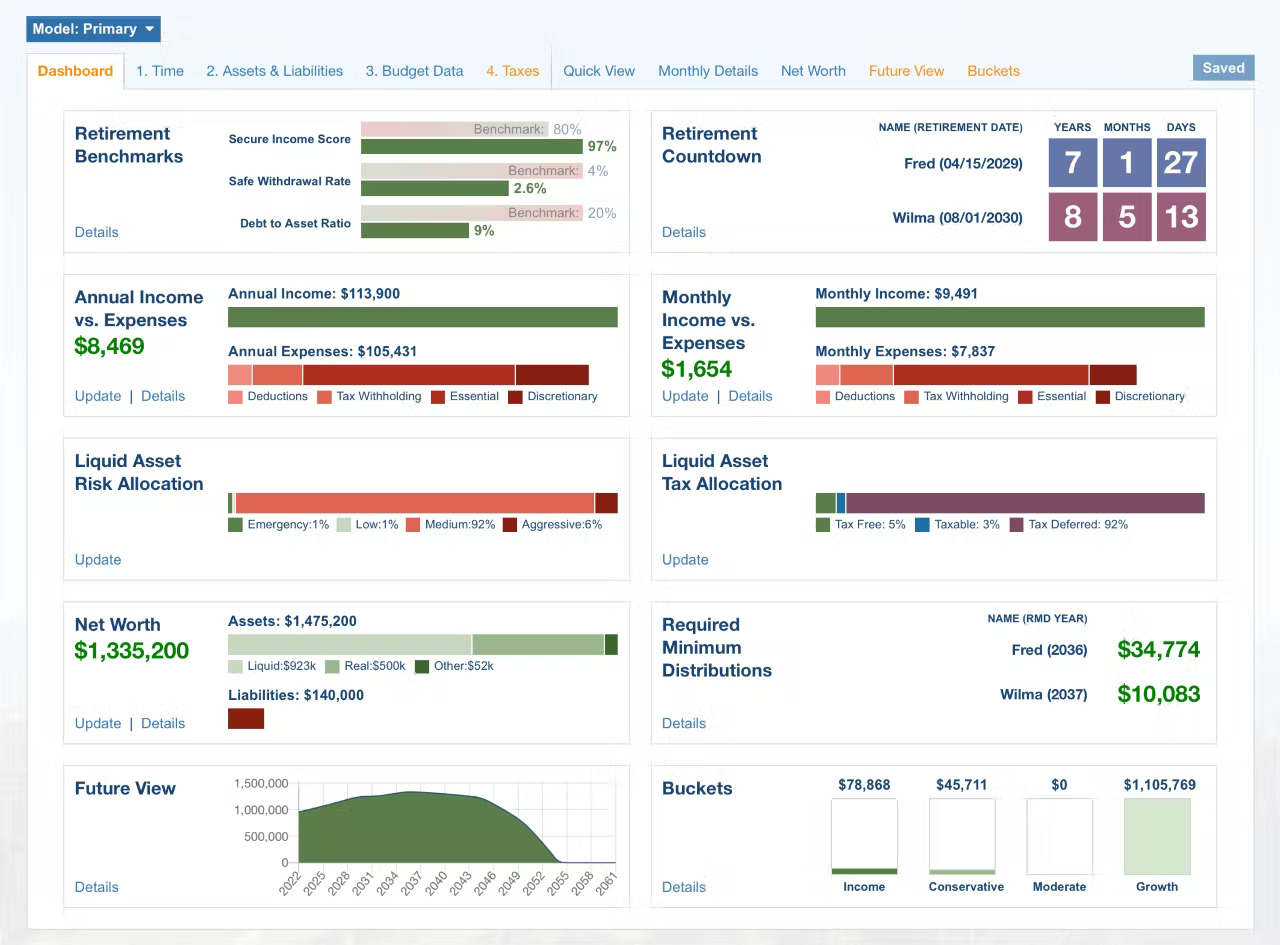

As a premium subscriber to the retirement budget calculator, you will be greeted with your Dashboard after you log in.

While planning your retirement, you’ve probably asked yourself, “Will my money last for the rest of my life?”

Every January there are a few important numbers you will want to update in your Retirement Budget Calculator. Here are my top 3 suggestions:

Deciding whether to pay off your mortgage is a critical financial planning decision, especially for those with limited savings. Paying off the mortgage offers improved cash-flow and peace of mind, but the financial costs may be too high for some retirees.

The reason you saved and invested in your 401k and IRA is so that one day you will have saved enough to be able to retire. But what is enough?

Asset allocation is one key to creating a cash flow strategy that works in retirement. But the cash flow strategy that worked during the wealth accumulation years may not work for a retiree. Retirees should take some time to re-evaluate their asset allocation, and make sure that it fits with their distribution strategy.

Retirees typically want to spent their retirement years with the people they love without worrying about their money. These popular portfolio withdrawal strategies are designed to help retirees fund their retirement without fear of running out of money.

Financial independence means you have enough money to cover all your expenses without working again. We share how to calculate your personal financial independence number, so you can see whether you're on track to achieve financial independence before retirement.

Healthcare costs are a non-negotiable line item in your retirement budget, but understanding how Medicare works can help you optimize your spending. This article covers six tips for keeping healthcare spending costs low while keeping quality high.